Market reserach ai: A Quick Guide to Faster Insights

Discover how market reserach ai turns complex data into clear insights, with practical models, applications, and a simple path to getting started.

What we're talking about when we say "market research AI" is the use of artificial intelligence to automate the grunt work of gathering, analyzing, and synthesizing market data. It essentially turns weeks of manual labor into a process that takes just a few minutes.

Think of it as a GPS for your business strategy. It can instantly map out market size, chart emerging trends, and give you a clear view of the competitive landscape. For founders, consultants, and product managers, this means making faster, more confident decisions backed by solid data.

Unlocking Smarter Decisions with Market Research AI

Imagine trying to navigate a new city by drawing a map from scratch. That’s what traditional market research often feels like. It’s a slow, painstaking process that involves countless hours sifting through reports, manually compiling data from dozens of different places, and trying to stitch it all together into a coherent picture of an industry. The final map is valuable, but the time and cost to create it can be a massive barrier, especially when you need answers right now.

This is exactly where market research AI changes the game. It’s the strategic equivalent of upgrading from that hand-drawn map to a real-time GPS. Instead of you plotting every point, an AI-powered system synthesizes an incredible amount of information—from financial statements and industry publications to social media chatter and patent filings—to generate a comprehensive analysis almost instantly.

The real value here isn't just about speed, though. It's about depth and accessibility. This technology gives teams who don't have massive research budgets or dedicated analyst departments access to the same high-quality intelligence that was once reserved for the big players.

The Shift from Manual Labor to Automated Insight

This transition to AI isn't just a small improvement; it's a fundamental change in how businesses can approach strategic planning. Powering this change is the explosive growth of the technology itself. The global artificial intelligence market, the foundation for these tools, was valued at USD 390.91 billion in 2025 and is on track to hit USD 3,497.26 billion by 2033. This incredible growth shows a clear move away from the old ways and toward AI-driven precision, which can deliver productivity boosts of up to 40%. You can dig into the complete artificial intelligence market forecast to see the full scale of this shift.

What this really means is that teams can finally stop drowning in data collection and start focusing on high-value strategic thinking. Instead of spending 80% of their time just gathering information and only 20% analyzing it, they can flip that ratio. The AI handles the heavy lifting of data aggregation, freeing up human experts to interpret the findings, ask smarter questions, and build winning strategies.

Key Takeaway: Market research AI isn't here to replace human strategists. It's here to supercharge them. It removes the friction of data collection so people can focus on what they do best—making smart, informed decisions that actually grow the business.

A Clear Comparison of Methods

To really get a feel for the impact, it helps to see the operational differences side-by-side. The table below breaks down the old way versus the new way of doing research.

The contrast makes it obvious why so many organizations are making the switch. An AI-powered approach delivers more than just efficiency; it provides a real competitive edge built on speed, depth, and the ability to act on insights before anyone else.

| Metric | Traditional Market Research | Market Research AI |

|---|---|---|

| Time to Insight | Weeks or months | Minutes or hours |

| Data Sources | Limited, often manual selection | Thousands of sources, automated |

| Cost | High (agency fees, subscriptions) | Lower, often subscription-based |

| Scalability | Difficult; requires more people | Highly scalable; runs multiple analyses |

| Bias | Prone to human/confirmation bias | More objective, data-driven |

| Scope | Often narrow and project-specific | Broad, holistic market view |

| Real-Time Analysis | Static; data is a snapshot in time | Dynamic; can incorporate real-time data |

Ultimately, adopting market research AI means you're no longer just reacting to the market—you're anticipating it.

How AI Models Power Market Analysis

To really get what makes AI-driven market research so fast and effective, you have to look under the hood. It’s not just one single technology at play. Think of it more like a highly specialized digital team, where each member has a distinct role in turning a chaotic mess of data into a clear, strategic report.

The process kicks off with models built to read and understand human language at an incredible scale. From there, other models jump in to hunt for hidden connections and even project what’s likely to happen next.

Natural Language Processing: The Master Reader

The first expert on this digital team is Natural Language Processing (NLP). Its entire job is to read and actually comprehend human language from millions of sources—dense financial reports, academic papers, messy customer reviews, news articles, you name it.

But NLP does more than just scan for keywords. It gets the context, the tone, and the sentiment. It knows the difference between a genuinely thrilled customer ("This battery life is unbelievable!") and a sarcastic one ("Unbelievable, the battery died in an hour."). That ability to grasp nuance is absolutely critical for getting the analysis right.

Machine Learning: The Pattern Detective

Once NLP has digested all that text, Machine Learning (ML) models take the baton. ML is the team's pattern detective, sifting through immense datasets to spot subtle correlations and emerging trends that a human analyst could easily overlook.

Think about it: could you manually connect a slight uptick in online chatter about "eco-friendly packaging" in Europe with a fractional rise in specific raw material costs in Asia? An ML model can spot those faint signals across thousands of sources and flag it as something worth watching.

Core Insight: The magic happens when NLP and ML work together. NLP reads and understands unstructured data like articles and reviews, turning it into something structured. Then, ML connects the dots to reveal the bigger picture.

Predictive Models: The Strategic Forecaster

The final member of the team is the Predictive Model. Using the patterns and trends that the ML algorithms uncovered, these models look ahead to forecast future market behavior. They’re built to answer the big, strategic questions:

- How fast will this market realistically grow over the next five years?

- Which customer segment looks poised for the highest demand?

- What could the competitive landscape look like 24 months from now?

These models work by analyzing historical data to build a statistical projection of what's coming. This forecasting is what elevates market research AI from a simple data-gathering tool into a genuine strategic partner.

It's this powerful combination that’s attracting serious investment. In 2024 alone, U.S. private AI funding hit $109.1 billion, fueling a new era of accessible market intelligence. With 62% of companies increasing their AI spend last year and 80% seeing revenue growth from real-time analytics, the business case is undeniable. You can dig deeper into the rise of AI investments and see its impact across the industry.

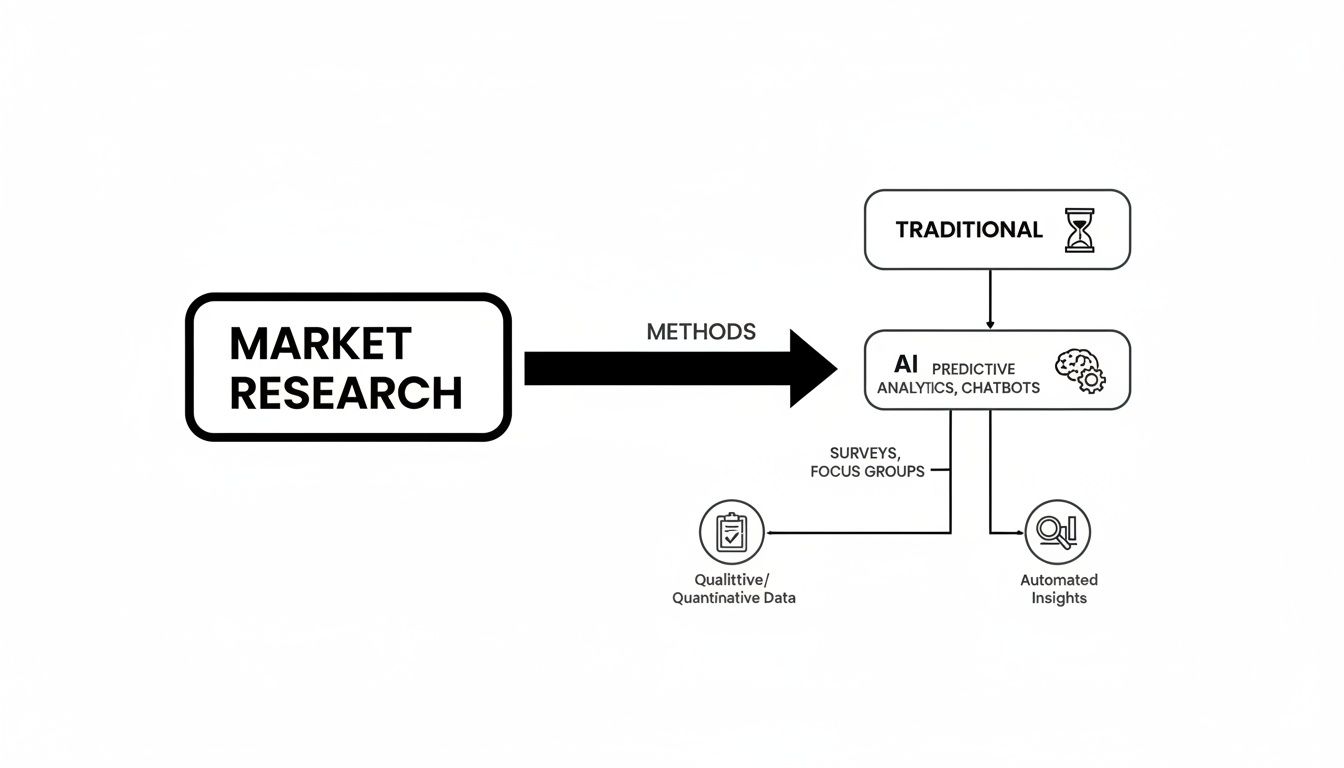

The flowchart below shows this shift perfectly, contrasting the slower, more traditional research methods with the accelerated, data-rich approach AI makes possible.

This visual contrast makes it clear how AI compresses the research timeline while dramatically expanding the depth of analysis. It turns a linear, manual slog into a dynamic, automated workflow. Working in concert, these AI models create a seamless process that takes a simple question and delivers a comprehensive, decision-ready market report.

Putting AI to Work: The Four Key Applications

Knowing the models behind market research AI is one thing, but seeing how they actually solve real business problems is where the rubber meets the road. These platforms aren't just academic exercises; they're powerful tools designed to tackle specific, high-stakes questions. They automate the grunt work of research, allowing teams to go from a nagging uncertainty to a data-backed decision with incredible speed.

This isn't just about being more efficient—it's about staying in the game. A staggering 89% of market researchers are already using AI tools regularly or at least experimenting with them. That number makes perfect sense when you consider that 83% of companies now see AI as a top strategic priority. This rush to adopt is fueled by the demand for tangible results, with 45% of organizations already deploying AI in three or more business functions. You can dig deeper into these shifts by checking out the state of market research in 2026 report.

Let's break down four of the most critical areas where market research AI is making a real impact.

Automated Market Sizing

Traditionally, figuring out a market's size is an absolute slog. An analyst might spend weeks, or even months, painstakingly piecing together financial reports, government stats, and industry publications. It’s slow, expensive, and riddled with potential for human error, making a quick "sanity check" on a new venture nearly impossible.

AI flips this entire process on its head. By using NLP models to scan and synthesize thousands of data points—from SEC filings to economic forecasts—an AI platform can spit out a credible market size estimate in a matter of minutes.

- Before AI: An analyst burns 40+ hours digging through databases to build a bottom-up model, costing the company thousands in billable time.

- After AI: You type in a query like "global laminated steel market" and get an instant report detailing its current value (e.g., USD 1.64 billion) and projected growth, complete with cited sources.

Dynamic Trend Detection

Catching a trend before it goes mainstream is the holy grail for any strategist. The old-school way involves a human manually monitoring news, social media, and trade journals—a process that's not only time-consuming but also limited by what one person can possibly track. It’s far too easy to miss the faint signals buried in all the noise.

Market research AI acts like a global listening post, constantly scanning millions of data points for emerging patterns and shifts in conversation. It can pick up on subtle increases in certain keywords or topics long before they become headline news.

For instance, an AI could have flagged the growing chatter around "sustainable packaging" across news articles, patent filings, and social media, identifying it as a major consumer driver months before competitors caught on. This gives a company the chance to pivot its strategy proactively instead of just reacting to the market.

Key Insight: AI trend detection isn't about what's hot right now. It’s about measuring the momentum behind an idea to predict what will matter tomorrow.

Intelligent Customer Segmentation

Great marketing starts with knowing your audience. For decades, segmentation relied on broad demographics like age, location, and income, which gives you a pretty flat, one-dimensional picture of your customers. This often leads to generic messaging that doesn't really connect with anyone.

AI allows for a much more sophisticated approach. By analyzing customer reviews, survey responses, and online behavior, it can group people based on their psychographics, pain points, and core motivations.

- Traditional Segmentation: "Millennial women, aged 25-35, living in urban areas."

- AI-Powered Segmentation: "Eco-conscious early adopters who value supply chain transparency and will pay a premium for ethically sourced goods."

This deeper insight lets you create hyper-relevant campaigns that speak directly to what each group actually cares about, massively boosting your effectiveness.

Automated Competitive Benchmarking

A solid strategy requires a clear-eyed view of your competitors' strengths and weaknesses. But building that view manually means a tedious hunt through websites, annual reports, and press releases, all while trying to normalize different data points into a coherent comparison.

AI automates this entire workflow. It can pull public data on a set of competitors and generate a structured benchmarking table that highlights key performance indicators in seconds. This gives you a rapid, apples-to-apples comparison that immediately surfaces strategic threats and opportunities.

Instead of losing a day to data collection, you get an instant snapshot comparing competitors across crucial metrics like:

- Annual revenue and 5-year growth rates

- Net profit margins

- Dependence on specific regional markets

- Recent strategic moves or product launches

This frees up your team to do what they do best: interpret the data and build a winning strategy, rather than getting bogged down in the mechanics of research.

A Step-By-Step Guide to Implementation

Knowing what market research AI can do is one thing, but actually putting it to work is where the real value lies. The good news? You don't need a massive technical overhaul. It’s a straightforward, five-step process designed to get you from a core business question to a decision-ready asset in well under an hour.

This structured approach is all about getting the most out of the technology. It forces you to focus your query, interpret the output efficiently, and turn those fresh insights into action. It’s about making data-driven decisions at the speed your business actually operates.

Step 1: Define Your Core Question

Before you even think about logging into a tool, the first job is to frame a clear, specific question. A vague query will always produce a generic, unhelpful report. The goal is to be so precise that the AI has no choice but to analyze exactly what you need.

Think in terms of concrete markets, geographies, and timeframes. "What's the deal with pet food?" is a weak question. A much stronger, actionable question is, "What is the current market size and 5-year growth forecast for direct-to-consumer (D2C) premium pet food in North America?" That level of specificity is the foundation for a useful report.

Step 2: Select The Right AI Tool

Not all AI research platforms are created equal. Your choice should hinge on the kind of answer you’re looking for. Some tools are brilliant at pulling sentiment from social media, while others are built to synthesize dense financial and industry data into highly structured reports.

For a comprehensive market overview, you’ll want a tool like StatsHub.ai that specializes in generating these structured reports. Look for platforms that offer:

- Global and regional data breakdowns to see the geographic nuances.

- Key metrics like market size, growth rate (CAGR), and major trends.

- Competitive benchmarking tables for a quick snapshot of the key players.

- Transparent source citation so you can quickly verify data credibility.

Step 3: Frame Your Query For Optimal Results

How you ask the question matters—a lot. Think of it like a search engine but with much higher stakes. Using clear, industry-standard keywords is the best way to guide the AI toward the most relevant data sources.

For instance, instead of just typing "self-driving cars," a more effective query would be "autonomous vehicle technology market" or "Level 4 autonomous driving systems." This simple shift helps the AI tap into financial reports and industry analyses instead of just surface-level news articles. Be specific, but don't get lost in jargon unless it’s the standard term for that market.

Step 4: Interpret The AI-Generated Report

Once the report lands in your inbox, resist the urge to get lost in the weeds. A well-designed AI report is built for speed. Start with the executive summary and the decision-ready outlook. This section gives you the big-picture takeaways in just a few sentences.

Next, jump straight to the key charts and tables. Look at the market size and growth forecast visuals first, then scan the competitive benchmarking table to see how the main players stack up. These core elements often contain 80% of the strategic value you need for an initial assessment.

Pro Tip: Immediately scan the report for the top three market drivers and the top three barriers. Understanding these opposing forces gives you instant context for the market’s growth potential and its inherent risks.

Step 5: Integrate Insights Into Your Workflow

The final, and most important, step is to make the insights actionable. A raw data report sitting in a folder is useless. The goal is to move from analysis to communication as quickly as you can.

Because AI-generated reports are often delivered in an editable format, you can quickly copy key charts, data points, and conclusions directly into your existing workflows.

- For Consultants: Drop the market size chart and competitive table straight into a client slide deck.

- For Founders: Use the executive summary and growth forecast to sharpen a pitch deck.

- For Product Managers: Pull the segmentation data and key trends into a new product brief.

Following this five-step process, you can reliably turn a pressing business question into a credible, data-backed asset. It’s all about empowering your team to make smarter, faster strategic moves.

Sample AI-Generated Market Report Structure

To make this even more concrete, here's a look at the typical structure of a high-quality, AI-generated report. This template shows how the information is organized for quick consumption and decision-making, moving logically from high-level summaries to granular details.

| Section | Key Information Provided | Primary Use Case |

|---|---|---|

| Executive Summary | Top-line findings, key numbers (market size, CAGR), and a "Decision-Ready Outlook" in 2-3 sentences. | Quickly grasp the report's main conclusions for go/no-go decisions. |

| Market Size & Forecast | Current market valuation (in USD billions), projected size, and Compound Annual Growth Rate (CAGR) for a 5-10 year period. | Understand the market's scale and future potential for business cases. |

| Key Trends & Drivers | The top 3-5 technological, consumer, or regulatory forces pushing the market forward. | Identify opportunities and tailwinds to align your strategy with. |

| Barriers & Challenges | The top 3-5 obstacles, risks, or competitive pressures holding the market back. | Assess risks and develop mitigation strategies. |

| Market Segmentation | Breakdown of the market by product type, application, region, or end-user. | Pinpoint the most lucrative niches and target customer profiles. |

| Competitive Landscape | A table or list of major players, their market share, and a brief description of their positioning. | Benchmark against competitors and identify strategic gaps. |

| Data Sources | A list of all primary and secondary sources used to compile the report for verification. | Ensure data credibility and enable further deep-dive research. |

This structure isn't just a random assortment of data; it's a narrative designed to answer your core business question efficiently. By knowing where to look, you can extract the most critical information in minutes, not days.

How To Evaluate AI Tools and Avoid Common Pitfalls

Jumping into AI-powered market research feels like a major upgrade, but let’s be honest: not all tools are created equal. A sleek dashboard can easily mask a weak engine, so you need to know what to look for under the hood.

Choosing the right platform is a lot like hiring a new analyst. You wouldn't hire someone without checking their references and seeing how they work, right? The same diligence applies here. Otherwise, you risk building a beautiful strategy on a foundation of sand.

Core Criteria For Evaluating AI Research Tools

When you're kicking the tires on different AI research platforms, there are three things that absolutely matter. These are the non-negotiables that separate a genuinely useful tool from one that just spits out pretty, but meaningless, charts.

Data Source Transparency: This is everything. If an AI tool tells you a market is worth $2.4 billion but won’t show its work, it’s a black box. You have to ask: where is this data coming from? A solid platform will openly cite its sources—financial reports, industry publications, government datasets. Trustworthy analysis starts with verifiable sources. It's that simple.

Model and Data Recency: Markets don't stand still, and analysis based on last year's data is already a history lesson. Find out how often the tool’s data and models get updated. Is it pulling from the latest quarterly earnings calls or relying on a static database from 2022? Your decisions have to be based on what the market looks like today, not what it was yesterday.

Output Usability and Integration: Even the most brilliant analysis is worthless if you can't easily use it. The best tools deliver reports that are not only clear and digestible but also fit right into your workflow. Look for platforms like StatsHub.ai that give you an editable file, not just a locked PDF. This lets you grab charts and data points for your presentations without having to re-type everything by hand.

Navigating The Most Common Pitfalls

Even with the perfect tool, remember that AI is your co-pilot, not the pilot. It’s a powerful assistant, but it’s not a substitute for your own critical thinking. Blindly trusting its output is a fast track to making some serious strategic blunders.

Crucial Reminder: Your job isn't going to be taken by AI. As experts at Harvard have pointed out, "It will be taken by a person who knows how to use AI." Your role is evolving—you're the one who needs to guide, question, and validate what the AI produces.

Here are the biggest traps to watch out for:

AI Hallucinations: This happens when an AI model makes things up with complete confidence. It might invent a competitor, cite a fake statistic, or misrepresent a source. Always, always spot-check the most critical numbers and claims against the original sources provided in the report.

Confirmation Bias: We all do it. You go into the research hoping to find support for your great idea, so you naturally gravitate toward the data that confirms it. You might focus on the promising growth forecast and conveniently ignore the section on regulatory hurdles. Force yourself to play devil's advocate and actively look for evidence that challenges your assumptions.

Over-Reliance Without Critical Thought: Don't just accept the report and forward it on. The AI gives you the "what"—the raw data and analysis. Your job is to provide the "so what?" and the "now what?" That means interpreting the findings and defining the actionable strategy that follows. That's the human expertise AI can't replicate.

The Future of Market Intelligence

Market research AI is quickly evolving past the point of just generating faster, static reports. We're stepping into an era where market intelligence is a living, breathing part of a company's strategic nervous system. The entire focus is shifting from one-off projects to a state of continuous, dynamic monitoring of market signals.

This change is profound. Instead of asking, "What did the market look like last quarter?" leaders can now ask, "What is happening in my market right now?" This isn't just a minor improvement; it's a fundamental change in how businesses can react to opportunities and threats the moment they appear.

From Static Reports to Continuous Monitoring

The traditional market research model has always delivered a snapshot in time. You commission a report, data is gathered, and weeks later, you get a static document. While useful, that report starts to become outdated the second it’s finished. Market research AI is collapsing that time lag, creating platforms that feel more like a live dashboard than a historical archive.

Think of it as an intelligent system that constantly scans thousands of data sources on your behalf. It could send you an alert the minute a competitor files a new patent, or when negative sentiment about one of your key product features starts trending online. This is where we're headed: intelligence that is proactive, not just reactive.

The Rise of Conversational Research

Another huge leap forward is the move toward conversational AI interfaces. Forget about trying to frame the perfect, complex query. Soon, you'll just have a natural dialogue with your research platform, allowing for a much deeper and more iterative exploration of tough questions.

You can start broad and then drill down with follow-up questions, just like you would with a human analyst.

- Initial Question: "What's the market size for electric vehicles in Europe?"

- Follow-up: "Okay, now break that down by country and show me the growth rate for charging infrastructure in Germany."

- Deeper Dive: "Which companies are leading in battery technology patents within that region?"

This back-and-forth makes sophisticated analysis accessible to people who aren't data scientists, empowering anyone on a team to get the specific answers they need without specialized training.

Your job will not be taken by AI. It will be taken by a person who knows how to use AI.

This gets to the heart of how professional roles are changing. The future isn't about being replaced; it's about amplifying human expertise with incredibly powerful tools. The strategist's job shifts to guiding the AI, interpreting its findings, and making the final, nuanced human decision.

AI Governance and Hyper-Personalized Insights

Looking ahead, two other areas are set to become critical. First, AI governance will step into the spotlight. As companies rely more heavily on these tools, ensuring the outputs are trustworthy, unbiased, and ethically sourced is non-negotiable. We'll see a much greater emphasis on transparent methodologies and data sources you can actually verify.

Second, the real magic happens when you integrate external market data with your company's internal data. By connecting market trends with your own sales figures, customer feedback, and operational metrics, AI can deliver hyper-personalized insights. It might pinpoint why a certain customer segment is churning by linking their feedback directly to a competitor's recent product launch—drawing a straight line from a market event to its impact on your bottom line.

Getting started with market research AI today isn’t just about making things more efficient. It's about laying the groundwork for a more agile, intelligent, and forward-looking company that's ready for whatever comes next.

Common Questions About AI in Market Research

Even with a clear roadmap, jumping into AI for market research brings up some practical questions. Let's walk through a few of the most common ones we hear from teams on the ground.

How Good Is The Data from These AI Tools, Really?

The short answer? It all comes down to the source material. The reliability of any AI-generated insight is directly tied to the quality of the data it's trained on. Look for platforms that are completely transparent about their sources—they should openly cite the financial filings, government databases, and respected industry reports they use. If a tool won't show you its work, be skeptical.

The best tools also act like a diligent analyst, cross-referencing information from multiple sources to validate their findings. This process, often called triangulation, ensures that a market size estimate or a growth forecast is a solid synthesis of available data, not just a shot in the dark.

Is AI Going to Replace Human Market Researchers?

Not a chance. Think of AI as an incredibly powerful research assistant, not a replacement for an expert. It's brilliant at handling the tedious 80% of the work—the heavy lifting of data collection, cleaning, and initial sorting. This frees up the human experts to focus on the strategic 20% where real value is created.

Your job will not be taken by AI. It will be taken by a person who knows how to use AI.

This means researchers can finally spend less time wrangling spreadsheets and more time on what truly matters: deep strategic analysis, spotting subtle market shifts, and translating complex data into a compelling story for stakeholders. These are tasks that demand critical thinking and deep business context, things AI simply can't replicate.

What's This Going to Cost Us?

The price tag on market research AI can be all over the map. Many enterprise-grade platforms lock you into hefty annual subscriptions, which can be a tough sell for smaller companies or for one-off projects where you just need a quick answer.

Thankfully, a more flexible model is gaining ground. Pay-per-report platforms like StatsHub.ai offer a much more accessible alternative. You can get a full-blown analysis for a small, one-time payment. This approach is perfect when you need to quickly validate a new idea or grab solid data for a pitch deck without committing to a massive contract.

Ready to get decision-ready market insights in minutes, not weeks? StatsHub.ai delivers comprehensive, slide-ready reports for a simple, one-time fee. Get your first report now at https://www.statshub.ai.

Ready to move faster?

Generate a market report in minutes, not weeks.

$15, easy to share, and ready for your team.