A Guide to the Different Types of Market Segmentation

Explore the different types of market segmentation. Learn how to choose the right strategy to refine your targeting, messaging, and drive business growth.

The different types of market segmentation are simply methods for breaking down a broad audience into smaller, more focused groups based on what they have in common. The classic models include demographic (who they are), geographic (where they are), psychographic (why they buy), and behavioral (how they act), but there are also more specialized types for B2B contexts.

Unlocking Growth with Strategic Market Segmentation

Imagine you’re trying to sell something by shouting into a packed stadium, just hoping someone—anyone—listens. Your message is vague, your reach is massive, but your actual impact is almost zero. That’s what marketing looks like without segmentation. Now, picture yourself having a real conversation with your perfect customer, understanding exactly what they need and why. That's the power of a smart segmentation strategy.

At its heart, market segmentation is the discipline of dividing a large, messy market into smaller, well-defined subgroups. We create these segments based on shared characteristics, which allows businesses to finally move past generic, one-size-fits-all tactics. This isn't just a marketing task; it's a core business strategy that shapes everything from product roadmaps to go-to-market plans.

Before we dive into the specific models, let's get a high-level view of the landscape. The table below outlines the primary segmentation types we'll be covering and the core questions each one helps you answer. Think of it as a quick-reference map for the rest of this guide.

An Overview of Key Market Segmentation Types

| Segmentation Type | Core Focus | Primary Question Answered |

|---|---|---|

| Demographic | Observable personal attributes | Who is the customer? |

| Geographic | Physical location | Where is the customer? |

| Psychographic | Internal traits and values | Why does the customer buy? |

| Behavioral | Actions and interactions | How does the customer behave? |

| Firmographic | Company-specific attributes | What kind of company is it? (B2B) |

| Technographic | Technology stack and usage | What technology do they use? (B2B) |

This table provides a starting point, but the real power comes from understanding the nuances of each type and knowing when to combine them.

The Strategic Value of Segmentation

When you truly understand the distinct needs and habits of different customer groups, you can start allocating your resources much more intelligently. This precision is a major competitive advantage. Instead of burning your budget on audiences who will never convert, you can double down on the segments that will deliver the highest return.

At its core, market segmentation answers a fundamental business question: "Who are our most valuable customers, and how can we serve them better than anyone else?" It transforms abstract market data into actionable human insights.

This focused approach brings several powerful benefits that directly boost the bottom line:

- Improved Marketing ROI: Concentrating your budget on high-potential segments makes your marketing spend far more efficient, leading to higher conversion rates and better overall campaign performance.

- Enhanced Product Development: Insights from segmentation can shine a light on unmet needs or specific pain points, guiding your team to build products and features that people actually want.

- Increased Customer Loyalty: When customers feel like a company "gets" them, they're much more likely to stick around. Personalized communication and relevant offers build relationships that last.

- Stronger Competitive Positioning: A clear segmentation strategy helps you carve out a defensible niche, making your brand stand out from competitors who are still trying to be everything to everyone.

Ultimately, getting a handle on the different types of market segmentation is the first step toward building a genuinely customer-centric organization. This guide will walk you through the most important models—from the basics like demographic and geographic to more advanced types like behavioral and firmographic—giving you the tools to find, analyze, and win the audiences that matter most. We'll break down each model and show you how to apply it to make smarter strategic decisions.

The Four Foundational Types of Market Segmentation

While you can slice and dice a market in countless ways, nearly every effective segmentation strategy is built on four core pillars. These are the fundamental lenses we use to understand who customers are, where they are, what drives their decisions, and how they interact with a product.

Getting a firm grip on these concepts is the first real step toward building a go-to-market plan that actually works.

Think of these four types as different filters. Each one reveals a unique layer of insight, and when you start combining them, you get a sharp, three-dimensional picture of your ideal customer. Let's dig into what each one tells you and why it matters.

Demographic Segmentation: Who Is Your Customer?

Demographics are the classic starting point for a reason: the data is objective, quantifiable, and relatively easy to get. It answers the most basic question you can ask: “Who is actually buying this?” It gives you a clean, factual snapshot of your audience.

This is all about sorting people by traits like age, income, education, and family status. In e-commerce, for instance, segmenting by income and household size is a proven winner. Brands can create family-sized bundles or pitch 'subscribe and save' offers that align with a customer's budget, often boosting average order value and repeat purchases by 20-30% in those campaigns.

Common demographic variables include:

- Age and Generation: Gen Z, Millennials, Baby Boomers, etc.

- Gender: Male, female, or non-binary identities.

- Income Level: Low, middle, or high-income brackets.

- Education Level: High school, bachelor's, master's degree, and so on.

- Occupation: Software developer, nurse, small business owner.

To make this work, you need a solid grasp of your audience's makeup, a topic covered well in this audience analysis demographics guide.

Example in Action: A luxury car brand isn't just selling to "rich people." They're targeting a very specific demographic: individuals aged 45-65 with a household income north of $250,000. Everything from their TV ads to the language on their website is crafted to connect with the lifestyle and financial reality of that group.

Geographic Segmentation: Where Is Your Customer?

This one is simple on the surface but incredibly powerful in practice. Geographic segmentation groups people based on where they live, work, and shop. The core idea is that location has a massive influence on needs, cultural norms, and buying habits. This approach answers, "Where are my buyers?"

You can go as broad as a continent or as granular as a single zip code. This allows you to tailor everything from product features to marketing messages. You might discover your software sells like crazy in dense urban hubs but gets zero traction in rural areas—a critical insight that shapes your entire sales and distribution strategy.

Common geographic variables include:

- Location: Country, state, city, or even neighborhood.

- Climate: Hot vs. cold, rainy vs. dry.

- Population Density: Urban, suburban, or rural.

- Language: Primary languages spoken in a region.

Example in Action: A national hardware chain uses geographic data to run a smarter inventory. Stores in the Northeast load up on snow blowers and ice melt in October, while locations in Florida are clearing space for hurricane shutters and pool supplies. It's a simple, data-driven way to meet local demand.

Psychographic Segmentation: Why Does Your Customer Buy?

If demographics tell you who is buying, psychographics tell you why. This is where things get interesting. You're moving beyond objective facts and into the messy, human world of values, attitudes, interests, and lifestyles. It’s also where you build real brand love.

Psychographic insights bridge the gap between knowing what a customer looks like on paper and understanding what truly motivates them. It’s the difference between targeting a "35-year-old urban professional" and targeting a "sustainability-conscious minimalist who values experiences over possessions."

Getting this data requires more than just census reports; it often comes from surveys, user interviews, and social media listening. The goal is to understand what makes your audience tick.

Key psychographic variables include:

- Lifestyle: Hobbies, travel habits, entertainment choices.

- Values and Beliefs: Core principles like environmentalism, family focus, or social justice.

- Personality Traits: Adventurous, analytical, introverted, security-conscious.

- Interests: The topics and activities they genuinely care about.

Example in Action: A high-end fitness brand isn't just selling workout clothes. They're targeting a psychographic segment that sees fitness as a core part of their identity. Their marketing avoids talking about "losing weight" and instead focuses on empowerment, personal achievement, and community—appealing directly to the deeper motivations of that group.

Behavioral Segmentation: How Does Your Customer Act?

Finally, we have behavioral segmentation, which groups people based on their direct actions and interactions with your company. This is arguably the most actionable of the four because it’s based on what people have already done, which is the best predictor of what they'll do next. It answers, "How do our customers engage with us?"

This data gives you direct clues for optimizing the customer journey. By looking at purchase history, feature usage, and loyalty, you can deliver incredibly relevant offers and messages that encourage repeat business.

Common behavioral variables include:

- Purchase History: How often they buy, how much they spend (AOV), and what products they prefer.

- Usage Rate: Are they a power user, a casual user, or have they gone dormant?

- Brand Loyalty: Do they stick with you no matter what, or are they easily swayed by a competitor's discount?

- Benefit Sought: The specific value they're after—convenience, status, low price, or top-tier quality.

Example in Action: A streaming service like Netflix is a master of behavioral segmentation. Its recommendation engine is fueled by what you watch, what you skip, what you re-watch, and even the time of day you log in. This isn't a nice-to-have feature; this personalization, driven entirely by behavioral data, is estimated to influence over 80% of what users decide to watch next, keeping them subscribed month after month.

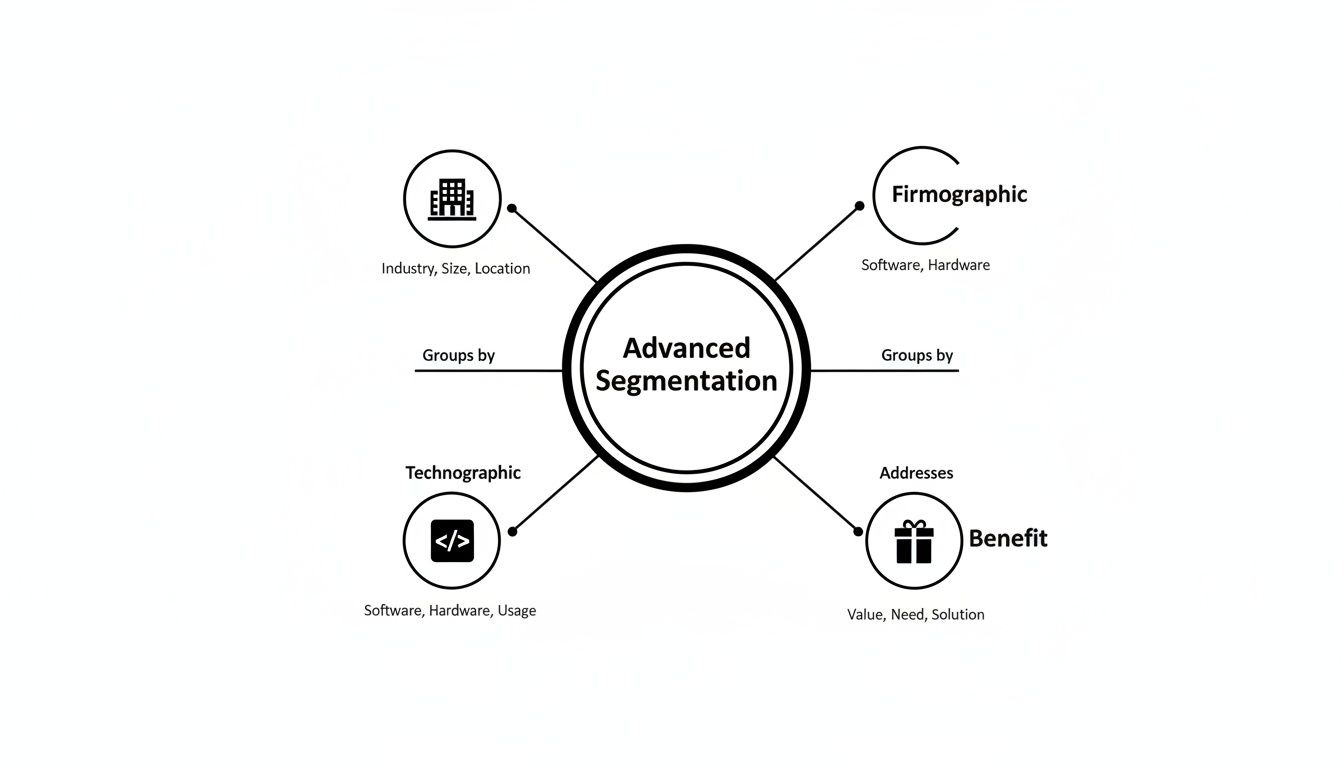

Unlocking Deeper Insights with Advanced Segmentation Models

Foundational models give you a solid map of your market, but the real treasure—the competitive edge—is often buried a little deeper. This is where advanced segmentation comes in. These models push beyond the simple "who" and "where" to uncover the more subtle drivers of customer behavior, which is especially critical in crowded B2B and consumer markets.

By layering on these more sophisticated approaches, you can build a much richer, multi-dimensional picture of your customers. Instead of just knowing a customer's title or location, you start to grasp their organizational context, their tech dependencies, and the specific outcomes they're trying to drive. That level of insight is what elevates a generic pitch into a value proposition that truly hits home.

Firmographic Segmentation: The B2B Demographic

Think of firmographic segmentation as demographics, but for companies. Instead of looking at an individual’s personal traits, you’re analyzing the characteristics of an organization. This is a non-negotiable for any B2B company because it’s the first filter for identifying which accounts are even worth pursuing.

Firmographics stop you from treating the entire business world as a single, uniform entity. It’s all about using objective, verifiable company data to slice the market and focus your energy. It answers the fundamental question, "What kind of company is this, and are they a good fit for what we sell?"

Key firmographic variables include:

- Industry: Segmenting by sector (e.g., SaaS, healthcare, manufacturing) lets you speak directly to specific industry pain points and regulations.

- Company Size: Usually measured by employee count or annual revenue, this directly impacts everything from potential deal size to the complexity of the sales cycle.

- Location: A company's headquarters or operational footprint can dictate everything from logistical needs to its familiarity with certain technologies.

- Ownership Structure: The priorities and purchasing processes of a public company are worlds apart from those of a private firm or a government agency.

Example in Action: A B2B work management platform like Asana uses firmographics to create entirely different playbooks. For a Fortune 500 enterprise, their pitch is all about scalability, enterprise-grade security, and integrating across thousands of users. But when they target the non-profit segment, the conversation shifts to affordability, team collaboration for mission-driven work, and special pricing.

Technographic Segmentation: Understanding the Tech Stack

In today's world, you can tell a lot about a company by the technology it uses. Technographic segmentation groups potential customers based on their current technology stack—the hardware, software, and other digital tools they’ve already bought into.

This model is absolutely essential for any company selling a solution that needs to play nice with a customer's existing systems, like SaaS platforms or IT service providers. It helps you instantly spot companies that are a natural technical fit and, just as importantly, identify those struggling with a competitor's tool.

A company’s tech stack is a massive tell. It signals their maturity, budget, and strategic priorities. A business investing in Salesforce and Marketo is a fundamentally different prospect than one still running its sales process on spreadsheets.

By analyzing a prospect's tech, you can:

- Identify Integration Opportunities: Find companies using complementary software (like a CRM that pairs perfectly with your marketing tool).

- Target Competitor Users: Go after businesses using a rival product and build your pitch around your key differentiators.

- Assess Tech Sophistication: Figure out if a company is an early adopter or a laggard, which tells your sales team how to frame the conversation.

Example in Action: A cybersecurity firm could use technographics to target companies that run their infrastructure on Amazon Web Services. Knowing this allows the firm to craft laser-focused marketing that speaks directly to AWS-specific vulnerabilities and compliance challenges, making their pitch immediately relevant and urgent.

Benefit Segmentation: Focusing on the "Why"

Why do customers really buy your product? Benefit segmentation gets to the heart of this question by grouping people based on the primary value or outcome they're looking for. It forces a shift in perspective—away from who the customer is and toward what they want to achieve.

It’s one of the most powerful models for shaping both product development and messaging because people often buy the exact same thing for wildly different reasons. One customer might prioritize convenience, another might be all about durability, and a third could be seeking the status that comes with your brand.

Example in Action: Just look at the market for running shoes. You’ll find distinct benefit segments:

- The Performance Seeker: This runner is buying speed and a competitive edge. They're drawn to specs like carbon-fiber plates and ultra-lightweight materials.

- The Comfort Seeker: This person wants cushioning and support for their daily jog. They respond to promises of joint protection and a plush feel.

- The Style Seeker: This segment sees running shoes as a fashion accessory. Their decision is driven by design, exclusive colorways, and brand hype.

All three groups are buying "running shoes," but they're really purchasing three completely different benefits.

Occasion-Based Segmentation: Targeting the Moment of Need

Sometimes, timing is everything. Occasion-based segmentation groups buyers according to when they think of buying, make their purchase, or actually use the product. It’s built on the idea that needs can be temporary and highly situational.

This strategy is incredibly effective for products tied to specific life events, holidays, or predictable routines. It’s all about being top-of-mind at the precise moment a customer’s need crystallizes.

Common occasions include:

- Universal Occasions: Holidays like Valentine's Day or Christmas create predictable spikes in demand for gifts, travel, and food.

- Recurring Personal Occasions: Birthdays and anniversaries happen every year, creating a regular, individual purchasing cycle.

- Rare Personal Occasions: A wedding, a new baby, or a move to a new city can trigger a sudden, intense need for a whole host of new products and services.

Example in Action: A gourmet food company like Harry & David lives and breathes this model. Their entire marketing calendar is structured around holidays—Christmas, Mother's Day, Easter. They also target personal occasions, using CRM data to send "anniversary coming up?" reminders to prompt a purchase at the perfect time.

Comparing Foundational vs Advanced Segmentation Models

The foundational models we discussed—demographic, geographic, psychographic, and behavioral—are the building blocks of any good segmentation strategy. They provide the essential "who, where, what, and why." But to build a truly robust and defensible market position, you often need to layer on the advanced models we've just covered. The table below breaks down when to stick with the basics and when to go deeper.

| Model Type | Primary Use Case | Data Sources | Strategic Benefit |

|---|---|---|---|

| Foundational | Broad market understanding, top-of-funnel targeting, initial product-market fit. | Census data, surveys, web analytics, CRM data. | Provides a high-level view to define your total addressable market and create initial buyer personas. |

| Advanced | Granular targeting, account prioritization, product differentiation, and competitive positioning. | Tech stack analysis tools, industry reports, customer interviews, purchase timing data. | Uncovers nuanced needs and buying triggers, enabling highly relevant messaging and targeted product development. |

In short, foundational models help you see the forest. Advanced models help you identify the most valuable trees—and understand exactly what kind of nourishment they need to grow. The strongest strategies almost always blend both, using foundational data to define the landscape and advanced insights to win specific, high-value territories within it.

How to Choose and Combine Segmentation Models

Knowing the different types of market segmentation is one thing. Knowing which ones to use—and how to layer them together—is what turns a classroom exercise into a real-world, revenue-driving strategy. The goal isn't just to pick one model off a list; it's to build a multi-dimensional view of your customer that actually informs what you do next.

A good starting point is to ask when the foundational data, like demographics, is actually enough. If you're selling a mass-market consumer product, simple demographic and geographic data might get you pretty far in defining an initial audience. But for a niche product or a high-value B2B service, that’s just scratching the surface. You have to go deeper to understand the why behind the purchase.

Building a Multi-Dimensional Customer Profile

The sharpest segmentation strategies combine multiple models to create a cohesive Ideal Customer Profile (ICP) or buyer persona. Think of it as creating a composite sketch of your best customer. Each segmentation type adds another critical detail, moving the picture from a blurry outline to a clear, recognizable portrait.

For instance, a new fintech app targeting young professionals wouldn't just stop at demographics. A genuinely powerful ICP would fuse several data types into one profile:

- Demographic: Age 25-40, living in a major urban center.

- Behavioral: Frequently uses mobile payment apps and has a history of investing in ETFs.

- Psychographic: Values convenience, seeks financial control, and is an early adopter of new technology.

This layered approach gives you a segment that isn't just an age bracket. It's a group of people with specific habits, attitudes, and motivations, which makes it much easier to connect with them through relevant messaging and product features.

A Framework for Combining Models

There's no single magic formula for every business, but a strategic framework can help guide your choices. The best approach is often to start broad and then add layers of specificity based on your goals.

- Start with "Who" and "Where": Use demographic and geographic data to draw the boundaries of your total addressable market. This is your high-level map.

- Add Behavioral Data: Next, layer in behavioral data from your CRM or analytics tools. This helps you identify your most engaged and valuable existing customers and reveals proven patterns of success you can replicate.

- Incorporate Psychographics for the "Why": Psychographic segmentation gets to the heart of what drives purchases by grouping people based on values, attitudes, and lifestyles. This is absolutely critical for personalization. In fact, 94% of marketers now use AI to layer psychographics for creating resonant content like blog posts and videos. To get a better sense of this trend, you can explore additional marketing statistics from HubSpot.

- Apply B2B Filters (If Applicable): For B2B companies, overlay firmographic and technographic data to qualify accounts based on their industry, size, and existing tech stack.

This diagram shows how more advanced models build upon foundational data to create a far more sophisticated targeting strategy.

As you can see, advanced segmentation moves beyond basic customer traits to focus on specific business contexts and desired outcomes.

The ultimate goal is to create segments that are MAAS: Measurable, Accessible, Actionable, and Substantial. A segment is useless if you can't measure its size, reach it with marketing, tailor your strategy for it, or if it's simply too small to be profitable.

Ultimately, choosing and combining segmentation models is an iterative process. You start with a hypothesis, test it with a targeted campaign, analyze the results, and refine your approach. The most successful companies don't treat their segments as static categories; they see them as dynamic reflections of an ever-changing market.

Putting Your Segmentation Strategy into Action

Pinpointing the right market segments is a crucial analytical exercise, but its real worth is only unlocked when those insights drive tangible business decisions. A well-defined segment isn't a static report gathering dust; it's a living, breathing input that should directly shape your go-to-market strategy, product roadmap, and brand messaging. It’s about getting every part of the organization aligned and focused on the same high-value customers.

This is where the theory ends and the real work begins. Instead of building a product and then desperately searching for an audience, you build for the audience you’ve already identified. Each segment’s unique needs, pain points, and behaviors become the North Star for every action you take.

Activating Segments Across Your Organization

For any of this to work, it has to be a coordinated effort. Segmentation insights can't stay siloed in the marketing department. They need to become a shared language for product, sales, and customer success teams. This is the only way to ensure a consistent and truly relevant customer experience at every single touchpoint.

A smart, practical first step is to implement lead scoring best practices to help your sales teams focus their energy on high-potential prospects. By assigning values to leads based on how closely they match your ideal segment profiles, you can prioritize sales efforts, shorten sales cycles, and dramatically improve conversion rates. This operationalizes your segmentation, turning a strategic concept into a daily sales motion.

Case Study: A B2B Software Company

Let's walk through an example. Imagine a B2B software company that just completed a segmentation analysis. By combining firmographic and behavioral data, they’ve identified two primary segments:

- Scaling Startups: Companies with 50-200 employees, growing fast, and always trying new software. They value speed, flexibility, and easy integration above all else.

- Mature Enterprises: Fortune 1000 firms with over 5,000 employees and deeply entrenched tech stacks. Their decisions are driven by security, compliance, scalability, and dedicated support.

With these two distinct segments defined, the company can now systematically tailor its entire go-to-market approach. It stops trying to be everything to everyone and starts delivering specific value to each group.

This clarity immediately impacts several key business functions:

- Marketing Campaigns: The "Scaling Startups" segment sees digital ads on tech forums and social media that highlight quick setup and ROI. In contrast, "Mature Enterprises" are targeted with in-depth whitepapers, webinars on security protocols, and strategic account-based marketing (ABM) campaigns.

- Sales Pitches: The sales team scraps its one-size-fits-all script and develops two distinct approaches. For startups, the pitch is all about agility and gaining a competitive edge. For enterprises, the conversation centers on risk reduction, governance, and the value of a long-term partnership.

- Product Roadmap: The product team now has a clear mandate. A lightweight, API-first feature is fast-tracked for the startup segment, while an advanced security and auditing module gets prioritized for the enterprise segment.

Behavioral segmentation, in particular, is powerful here. It shifts the focus from 'who' customers are to 'what they do,' analyzing their purchase history and usage patterns to anticipate future needs. This approach is a loyalty-building machine; brands often report a 2-3x higher ROI when they prioritize it over static demographics. For instance, FinTech robo-advisors use it to create segments like 'Novice Investors' and 'Seasoned Traders'—a strategy that has led to 40% higher retention rates.

By embedding these different types of market segmentation into its core operations, the software company transforms an analytical project into a powerful engine for growth. It ensures that every decision, from a single marketing email to the next major product release, is strategically aligned with its most valuable customers.

Common Questions About Market Segmentation

Even when you've got a handle on the different segmentation types, a whole new set of questions pop up when it's time to actually put them to work. Getting these practical details right can be the difference between a segmentation model that genuinely guides your strategy and one that just adds a layer of complexity. Let's dig into some of the most common questions we see teams grapple with.

How Many Market Segments Should We Actually Target?

There’s no magic number here, but the guiding principle is always focus. Most winning strategies don't try to be everything to everyone. They start by zeroing in on just one to three core segments.

Spreading your resources too thin by chasing too many groups at once is a recipe for disaster. Your message gets diluted, your efforts get scattered, and you end up with mediocre results everywhere. It's far better to dominate a few carefully chosen niches than to be a forgettable player in a dozen.

Your goal isn't just to create segments, but to find real opportunities. Make sure your chosen few meet these criteria:

- Substantial: Is the segment actually big enough to justify the investment and turn a profit?

- Reachable: Can you realistically get in front of these people with your current marketing and sales channels?

- Differentiable: Are their needs and behaviors truly distinct enough to need a unique approach?

If you can't say "yes" to all three, you might be segmenting for the sake of it.

What Are the Most Common Mistakes in Market Segmentation?

It's easy to go wrong with segmentation, and many teams fall into the same traps. A classic mistake is creating segments that are so small or niche they could never be commercially viable. Another is building your whole strategy on outdated or just plain wrong data, which leads to flawed assumptions from the get-go.

One of the biggest blunders is focusing only on who the customer is (demographics) while totally ignoring why they buy (psychographics). This gives you a flat, one-dimensional picture that misses the very motivations that drive purchasing and create loyalty.

Other common missteps? Keeping the segmentation work siloed in the marketing department instead of embedding it across product, sales, and service. And finally, treating segmentation as a one-and-done project. Markets change, customers evolve, and your segments need to be revisited and refreshed regularly to stay relevant.

How Can I Get the Data I Need for Segmentation?

Solid segmentation is built on a rich, multi-layered data foundation. You can't rely on a single source to tell you the whole story; you have to combine different types of data to get a clear picture.

Start with what you already own: your first-party data. This is gold. It’s the information you collect directly from your audience and customers—think CRM data, website analytics from a tool like Google Analytics, purchase histories, and customer feedback surveys. This data gives you undeniable insight into who your customers are and what they do.

To add another layer, you can look into second-party data by partnering with other companies that share a similar audience. And to fill in the rest of the picture, you can turn to third-party data from market research firms, government sources (like census data), or industry data providers. Pulling these sources together gives you the most robust and accurate base for building segments that actually work.

Ready to get the market data you need without the lengthy research process? StatsHub.ai delivers a comprehensive, slide-ready market report in minutes for just $15. Get instant access to market size, segmentation, trends, and competitive analysis to make faster, more confident decisions. Validate your market opportunity with StatsHub.ai today.

Ready to move faster?

Generate a market report in minutes, not weeks.

$15, easy to share, and ready for your team.