How to Find Target Market: A Practical Guide to Lasting Growth

Learn how to find target market and unlock growth with practical segmentation, validation, and prioritization.

Figuring out your target market is all about pinpointing the specific group of people most likely to actually buy what you're selling. This isn't just a vague idea; it's a deliberate process that breaks down into four essential stages: gathering intel on your existing customers and the competition, carving that audience into distinct segments, testing your assumptions with real-world data, and finally, prioritizing the groups that offer the most potential for growth and profit.

Beyond Demographics: A Modern Approach to Finding Your Market

Let's move past the outdated, static customer profiles. Today, knowing how to find your target market means getting a deep, nuanced understanding of the people who will become your most loyal—and valuable—customers over the long haul.

A well-defined market is the absolute foundation for every single marketing campaign, sales strategy, and product decision you'll ever make. It fundamentally shifts your company's focus from a desperate "Who can we sell this to?" to the much smarter question, "Who should we serve to build a truly sustainable business?"

This guide is designed to give you a dynamic framework for identifying, analyzing, and actually connecting with your ideal audience. The goal is to give busy leaders a clear, strategic map before they get lost in the day-to-day tactics. The bottom line is this: precision targeting isn't just a marketing task. It's a core business function that dictates where you spend your time and money.

The Core Strategic Flow

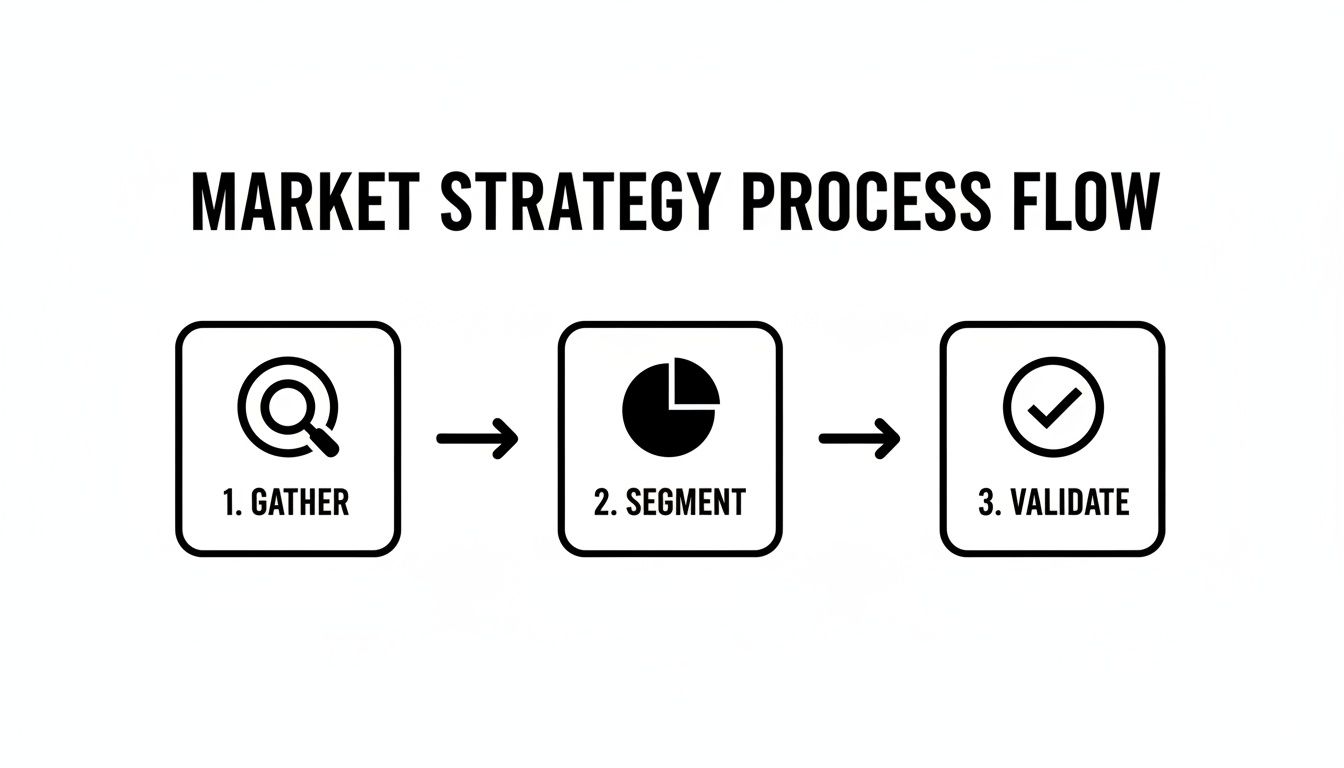

Think of this process not as a one-and-done task, but as a continuous cycle of learning and tweaking. You start with broad intelligence gathering, then progressively narrow your focus until you land on a clear, defensible go-to-market plan. This systematic approach ensures your big decisions are backed by evidence, not just a gut feeling.

A target market isn't just a pile of demographic data. It's a living, breathing group of people with specific needs, desires, and behaviors. The real magic happens when you understand the why behind their actions—that's what separates good marketing from great marketing.

This table breaks down the essential stages of the process, giving you a clear overview of the objectives and activities involved at each step.

Core Stages of Target Market Identification

| Stage | Objective | Key Activities |

|---|---|---|

| Intelligence Gathering | To build a comprehensive, data-driven foundation of market knowledge. | Analyze existing customer data, conduct competitor research, and identify broad market trends. |

| Segmentation | To group the broad audience into smaller, distinct segments based on shared traits. | Apply demographic, psychographic, geographic, and behavioral criteria to create detailed personas. |

| Validation | To test assumptions about each segment's viability and interest. | Run small-scale marketing experiments, conduct surveys and interviews, and analyze landing page tests. |

| Prioritization | To select the most promising segment(s) to focus resources on. | Score segments based on size, profitability, accessibility, and alignment with business goals. |

Each stage builds on the last, creating a logical flow from high-level research to a focused, actionable strategy.

The diagram below provides a simple visual of this strategic flow, from initial data collection all the way to final validation.

As the visual shows, effective market identification acts like a funnel. You move from broad research (Gather) to more precise grouping (Segment), and finally to evidence-based confirmation (Validate). Following this progression ensures you don't pour resources into an audience before you've confirmed they're actually the right fit.

Finding the Clues to Your Ideal Customer

Before you can paint a clear picture of who you're selling to, you need to survey the landscape. This isn't about casting a wide, aimless net for information. It's about strategic intelligence gathering—building a solid, evidence-based foundation so your first guesses about your target market are educated ones.

The best place to start is with the most valuable asset you already have: your current customers. The real story of your market begins right there in your own data.

Dig Into Your Existing Customer Data

Your CRM or e-commerce platform is a treasure trove of information just waiting to be explored. Don't just look at who's buying; you need to understand how they're buying and, more importantly, why they stick around. Zero in on your most profitable and loyal customers to see what they have in common.

What kind of patterns start to emerge?

- Buying Habits: Are your best customers consistently purchasing certain product bundles? Do they jump on specific types of promotions?

- The Path They Took: How did they find you in the first place? Was it a particular social media channel, an old blog post, or a referral from a happy client?

- Feedback and Frustrations: Look for recurring themes in your support tickets and positive reviews. These often point directly to the exact pain points your solution solves better than anyone else.

One of the biggest mistakes I see is treating every customer as if they're the same. The truth is, your top 20% of customers are likely generating 80% of your revenue. Focus your energy on that high-value group first. They are the blueprint for what a "great" customer actually looks like.

This internal audit gives you a factual baseline. It helps you see the real-world characteristics of people who already get significant value from your work, moving your search for a target market from pure guesswork to a data-informed hunt.

Run a Smart Competitive Analysis

Once you have a handle on your internal data, it's time to look outward. Checking out your competitors is less about copying them and more about understanding who they think is the most valuable audience. Even more critically, it’s about spotting where they're dropping the ball.

Go deeper than just their homepage and pricing page. You need to become a student of their marketing.

- Content and Messaging: Pay close attention to the language they use. Is it all about technical features, or do they speak in terms of business outcomes? This is a huge tell about who they're trying to connect with.

- Social Media Footprint: Look at who is actually engaging with their posts. Are they attracting senior-level decision-makers on LinkedIn or a more hands-on, practitioner-level audience on other platforms?

This whole exercise helps you answer one crucial question: is there a pocket of the market that everyone else is ignoring? Maybe your competitors are all chasing enterprise clients, leaving a wide-open opportunity for a solution built specifically for mid-sized companies. Identifying these gaps is the secret to figuring out how to find your target market without wasting time and money. By seeing where the competition is—and where it isn’t—you can start to carve out a space that is uniquely yours.

Using Segmentation to Achieve Pinpoint Accuracy

Trying to be everything to everyone is a classic—and costly—mistake. It’s an expensive and deeply inefficient way to operate. The next logical move, once you have some initial data, is segmentation. This is the art of carving a large, undefined market into smaller, more precise groups who share specific needs, motivations, and characteristics. It’s how you bring a blurry, out-of-focus picture of your customer into high resolution.

Think of your initial market research as gathering raw materials. Segmentation is the framework you build with them. You're looking for the meaningful patterns that connect certain types of people, which in turn allows you to fine-tune your messaging, product features, and go-to-market strategy for maximum impact.

Moving Beyond Basic Demographics

Most segmentation efforts start with the basics: demographics (age, income, gender) and geographics (city, country). These are certainly useful, but they only tell you who people are and where they live. They don't explain the far more important question: why do they buy?

A real competitive edge comes from digging deeper and layering on more insightful forms of segmentation.

- Psychographic Segmentation: This is all about the psychological makeup of your audience—their lifestyle, values, interests, and personality traits. Are they tech-savvy early adopters? Do they make purchasing decisions based on sustainability?

- Behavioral Segmentation: This focuses purely on their actions and interactions with your brand. Are they first-time buyers or loyal, repeat customers? What specific benefits are they looking for? How often do they actually use your product?

This level of understanding is what turns a generic marketing message into something that feels personal and genuinely relevant. The data on this is crystal clear: 81% of consumers say they are more likely to do business with brands that offer personalized experiences. The financial upside is just as compelling. Companies that effectively segment their audiences have seen a staggering 760% increase in email revenue compared to those running unsegmented campaigns. You can find more data on the power of segmentation in Britopian's research.

Segmentation in Action

Let's ground this in a couple of real-world scenarios to see how it plays out.

Scenario 1: A B2B SaaS Company

Imagine a company selling project management software. Instead of targeting the vague category of "small businesses," they could segment their market by:

- Industry: Targeting marketing agencies that desperately need client-facing features, which are totally different from what a construction firm needing on-site mobile access would want.

- Tech Stack: Focusing on companies that already use tools like Slack or Google Workspace, which would make their own software a much easier sell.

- Company Maturity: Crafting different pitches for startups that need a simple, scalable solution versus established businesses that demand advanced reporting and analytics.

Scenario 2: A D2C Wellness Brand

Now, think about a direct-to-consumer brand selling nutritional supplements. They could segment their audience not by age, but by psychographics and behaviors:

- Lifestyle Goals: Creating distinct campaigns for "high-performance athletes" who are focused on results, versus "busy professionals" who just want something to help with stress relief.

- Purchase Behavior: Identifying a group of "subscription loyalists" who prioritize convenience over everything, and separating them from the "ingredient-conscious researchers" who will read every single label before buying.

By focusing on the why behind a customer’s needs—their professional goals, personal values, or daily habits—you can create buyer personas that feel like real people. These detailed profiles then become the compass that guides every marketing message and product feature you develop.

Validating Your Assumptions Before You Invest

Even the most thorough, data-driven segmentation exercise leaves you with one thing: an educated guess. It might be a fantastic hypothesis backed by solid research, but it's still a hypothesis. Going all-in on that assumption—betting your entire budget and roadmap—is a high-stakes gamble you don't need to take.

This is where validation comes in. It’s the crucial step where you run a series of small, low-cost experiments to see if your target market actually behaves the way your research suggests they will. Think of it as the bridge between your internal strategy documents and real-world market demand. It’s how you avoid building the perfect solution for an audience that doesn't exist or simply doesn’t care.

Running Low-Cost Validation Experiments

You don’t need to spend a fortune to test the waters. The whole point is to get meaningful signals with minimal investment. It’s all about quick, targeted tests to see which of your potential segments shows the most promise.

One of the most effective, classic techniques is to build segment-specific landing pages. For each persona you’ve defined, create a simple page that speaks directly to their unique problems and goals. The messaging should feel like it was written just for them. Once that's done, you can start driving a small, controlled amount of traffic.

Here’s how that might look in practice:

- Targeted Ad Campaigns: Fire up some small-budget campaigns on a platform like LinkedIn or Meta. Set up one ad targeting your "B2B SaaS startup founder" persona and a completely separate one for your "D2C wellness brand marketer" persona.

- Measure What Matters: Clicks are just vanity metrics here. You need to be looking at engagement rates, cost per lead (like an email sign-up for a waitlist or a demo request), and bounce rates. If your bounce rate is sky-high, your message is probably missing the mark. A surprisingly low cost per lead, on the other hand, is a very strong signal that you’ve struck a chord.

This early stage isn't about making sales; it's about buying information. Your goal is to see which segment lights up with interest for the lowest cost. A $200 ad spend that proves an audience is a dead end is infinitely more valuable than a $20,000 product launch that falls flat.

Gathering Direct Qualitative Feedback

Landing page data and ad metrics tell you what people are doing, but they can't tell you why. For that, you have to talk to them. Direct conversations are absolutely irreplaceable for digging into the real nuances of your customers' problems.

Customer interviews are probably the single most powerful validation tool you have. Find a handful of people who perfectly match your target persona, get them on a call, and just listen. Ask open-ended questions about their biggest challenges, what they’re using now to solve them, and what they think of your idea.

Surveys can also work wonders for gathering insights at a larger scale. Using tools like SurveyMonkey or Typeform, you can ask very specific questions about how much they’d be willing to pay or which features they value most.

Comparing Market Validation Methods

Choosing the right validation method depends entirely on what you're trying to learn and the resources you have available. Some methods are fast and cheap but yield directional data, while others are slower but provide deep, qualitative insights. Here’s a quick breakdown of the trade-offs.

| Validation Method | Relative Cost | Speed to Insight | Ideal for Testing |

|---|---|---|---|

| Landing Page Tests | Low | Fast | Messaging resonance, value proposition, initial demand |

| Customer Interviews | Low to Medium | Medium | Problem severity, user workflows, "why" behind the data |

| Surveys | Low | Fast | Feature prioritization, pricing sensitivity, market size estimates |

| "Wizard of Oz" MVP | Medium | Medium to Slow | Core product functionality, user experience, willingness to pay |

| Pre-Order Campaign | Low to Medium | Slow | Actual purchase intent (the ultimate validation) |

Ultimately, a mix of these methods is often the best approach. You might start with landing pages to see which messaging hits home, then follow up with interviews with the people who signed up to understand their motivations more deeply.

The feedback you get from these experiments—both the good and the bad—is pure gold. It's the raw material you need to refine your strategy, tweak your product, or even pivot entirely. This is how you move from a hypothesis to a confident, validated decision on which market to pursue.

Using AI to Jumpstart Your Market Research

Trying to conduct market research manually can feel like an endless slog. You spend weeks, sometimes months, patching together data from disparate sources, only to end up with an incomplete picture. AI-powered tools completely change this dynamic. They automate the grunt work of data collection and synthesis, turning a marathon into a sprint.

Instead of getting bogged down in the "how," these platforms let you focus on the "what" and "why." The impact is undeniable. The generative AI market is on a rocket ship trajectory, projected to blast from $62.75 billion in 2025 to a staggering $356.05 billion by 2030. And it's not just hype—a Gartner report suggests AI could boost business productivity by up to 40% by making sense of massive datasets. You can see more on AI's growing role in customer segmentation at superagi.com.

Putting AI Into Practice: A Real-World Scenario

Let’s make this tangible. Imagine you're exploring an idea for a new piece of project management software. The old way involved days of hunting down industry reports, scraping competitor websites, and trying to piece it all together.

With a tool like StatsHub.ai, the process is almost comically simple. You enter your keyword—"project management software"—and within minutes, you have a structured, slide-ready report. This gives you an instant, 30,000-foot view of the competitive landscape.

Here’s what that starting point looks like. A simple search box is your gateway to a treasure trove of organized data.

This single query unlocks the kind of foundational data—market size, key players, growth trends—that used to require a dedicated analyst and a serious budget.

AI research tools aren’t here to replace your strategic brain; they’re here to supercharge it. By offloading the tedious data-gathering, you free up your team to do what humans do best: interpret the findings, spot the hidden opportunities, and build a strategy that actually wins.

How to Read the Tea Leaves of an AI Report

Once the report is generated, you can quickly get a gut check on your idea's potential. Zero in on these key sections first:

- Market Size and Growth: Is this a pond or an ocean? More importantly, is the tide coming in or going out? You need to know if the market is big enough to support your ambitions and if it's actually growing.

- Customer Segments: The AI will break down the primary buyer personas—think "small businesses," "enterprise teams," or "freelancers." This immediately shows you who the main players are buying from and where untapped opportunities might be hiding.

- Competitor Analysis: You’ll get an instant snapshot of the incumbents, their market share, and their core focus. This is crucial for identifying overly crowded arenas and finding those valuable gaps in the market.

This automated first pass is your go/no-go filter. It gives you the hard data you need to either validate an idea and move forward with a deeper dive or disqualify it quickly before you waste precious resources. It's about making smarter, faster decisions on where to point your compass.

Prioritizing Your Market Segments for Maximum Impact

You’ve done the hard work of identifying and validating a handful of promising customer groups. Now comes the moment of truth. Picking where to focus your efforts is what separates businesses that just tread water from those that truly scale.

This is less about gut feelings and more about making a calculated bet. You have limited resources—time, money, and manpower—and you need to point them at the segment with the greatest potential. A simple, objective scoring system can take the emotion out of the decision and give you a clear, defensible path forward.

The Prioritization Framework: Making the Smart Bet

To make an informed choice, you need to evaluate each validated segment against the same set of business-critical criteria. This forces you to move past the initial excitement of a new idea and really scrutinize its long-term viability.

Here’s what I look at every time:

- Market Size & Growth Potential: Is this market big enough to hit your revenue targets? Even more important, what’s its trajectory? A smaller niche that's growing like a weed can be far more valuable than a massive, stagnant market.

- Profitability: Can you actually make money here? Think about their willingness to pay, the potential customer lifetime value (LTV), and what it costs to acquire them (CAC). A segment that pays a premium and doesn't swamp your support team is a beautiful thing.

- Accessibility: How hard is it to get in front of these people? Are they all hanging out on a few specific channels you can easily tap into, or are they scattered to the wind?

- Strategic Alignment: Does this segment actually fit your brand’s mission and what you’re good at? Chasing a misaligned segment can dilute your brand and stretch your team to the breaking point.

These factors are constantly in flux, especially with major economic shifts underway. For instance, Global Gen Z spending is climbing at double the rate of previous generations at the same age. At the same time, digital economies in places like Southeast Asia are ballooning by over 20% every year. Trends like these mean you have to be more strategic than ever. You can dig deeper into emerging market segmentation from globalbankingandfinance.com.

Give each potential segment a score from 1 to 5 for each of these criteria. The one with the highest total score isn't just a good idea—it's your data-backed starting point for focused execution and real, sustainable growth.

Common Questions About Finding Your Market

As you dive into market identification, a few key questions always seem to pop up. Let's clear up some of the most common points of confusion so you can build a strategy that’s laser-focused.

Target Market vs. Target Audience: What’s the Real Difference?

This one trips up a lot of people, but the distinction is actually pretty simple.

Your target market is the big picture—the entire group of potential customers your product or service is built for. Think "mid-sized B2B tech companies in North America." It’s a broad, strategic definition.

Your target audience, on the other hand, is the specific slice of that market you're actively trying to reach with a specific marketing message. For example, you might run a LinkedIn campaign targeting "VPs of Engineering at Series B tech companies." The market is who you can eventually sell to; the audience is who you're talking to right now.

How Often Should I Revisit My Target Market?

Defining your target market isn't a "set it and forget it" task. Markets are dynamic, and your assumptions can become outdated faster than you think.

A good rule of thumb is to conduct a full-scale review at least once a year. You should also trigger a review if you see major business shifts, like a dip in growth, a new competitor making waves, or a significant change in your product. On a smaller scale, it’s smart to do quarterly check-ins to make sure your day-to-day tactics still align with market reality.

The biggest mistake I see is teams treating their initial market research as gospel for years. Markets shift, customer needs change, and new trends emerge. Continuous validation is your best defense against becoming irrelevant.

What if My Product Could Work for Several Different Markets?

That's a good position to be in, but it’s also a classic trap. Spreading your resources too thin by trying to be everything to everyone is a recipe for failure. You need to focus.

The key here is ruthless prioritization. Run each potential segment through a scoring framework. Evaluate them based on criteria like:

- Market Size (TAM, SAM, SOM)

- Profitability and Willingness to Pay

- Accessibility (How easy is it to reach them?)

- Competitive Intensity

Score each segment, rank them, and then pick a winner. Go all-in on that first segment. Once you’ve established a strong foothold there, you can use that momentum to expand into your second-best segment. It’s about winning one beachhead at a time, not fighting a war on ten fronts at once.

Ready to stop guessing and start analyzing? Get a comprehensive, slide-ready market report in minutes with StatsHub.ai. Move from question to credible answer for just $15. Get Your Market Report from StatsHub.ai

Ready to move faster?

Generate a market report in minutes, not weeks.

$15, easy to share, and ready for your team.